Meeting regulatory requirements – professionally and efficiently with our SAP reporting solutions

In the U.S., insurance companies must report their assets and liabilities to the National Association of Insurance Commissioners (NAIC), the regulatory agency. The NAIC is under the authority of the 50 states. It coordinates the regulatory and supervisory activities of the various states and serves as a forum for the creation of statutory rules and models. In the United States, the Statements of Statutory Accounting Principles (SSAP) are certain accounting standards developed for regulatory purposes. NAIC reporting includes various statements, known as schedules, such as Schedule D and Schedule BA, and appendices, known as exhibits.

Our offer

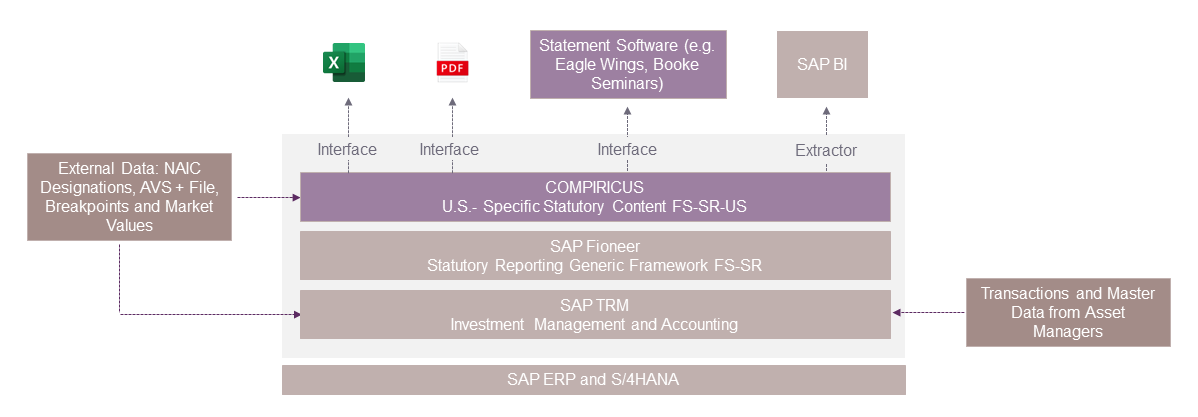

COMPIRICUS-FS-SR-US – NAIC Reporting enables you to create quarterly and annual reports for the U.S. regulatory agency NAIC. The solution for this is the COMPIRICUS add-on FS-SR-US, which is based on the SAP insurance reporting platform FS-SR. The software creates the reporting in the format required by the NAIC and offers numerous interfaces in the process.

FS-SR-US is integrated with the SAP Financial Asset Management (SAP FAM) architecture and the SAP support process via the Service Marketplace. SAP FAM (Financial Asset Management) is an investment accounting platform that can manage various assets and also various accounting systems according to the demanding requirements of the complex insurance industry.

COMPIRICUS software packages are already being used to deliver statutory data to the NAIC by more than 90 U.S. NAIC accounting groups.

Your safety

The COMPIRICUS team specializes in investment management and NAIC reporting. The reporting solution is integrated into your system landscape and adapted to your individual requirements.

Functionality

Our software enables the creation of the following reports:

The reporting supports all processes concerning:

Watch Video