Statutory Reporting with

SAP FS-SR in Germany

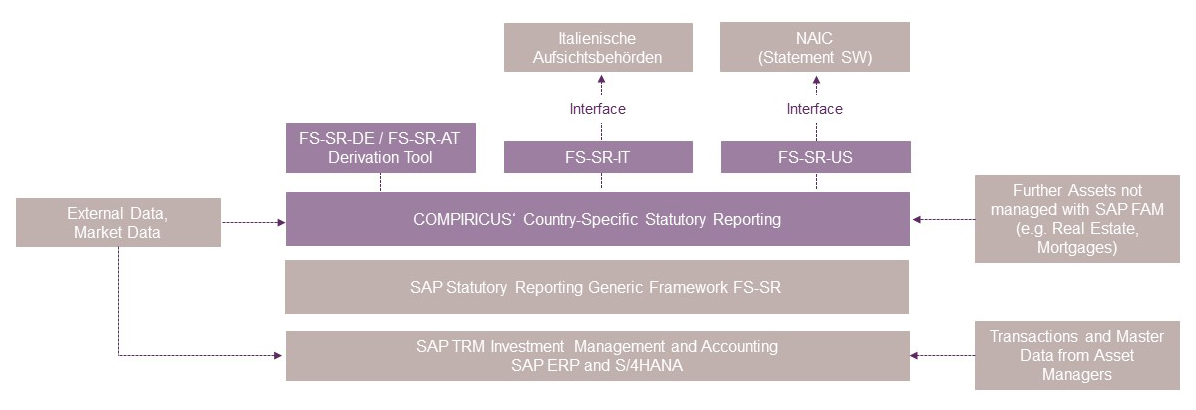

For more than 10 years, we have been working hand in hand with SAP – as a development partner for insurance reporting, among other things. Well-known German insurance companies therefore rely on our expertise, which is probably unique in the insurance market:

Consulting

Consulting on all aspects of BaFin reporting with SAP

New Statutory Requirements

Necessary adjustments to new statutory requirements of BaFin

Master Data Derivative Tool

Add-on for SAP FS-SR-DE for fully automatic generation and verification of your securities reporting indicators

Maintenance

Customized further development of the SAP reporting module FS-SR-DE

Previous References and Projects